In trading, one of the essential topics you need to understand is risk management.

It doesn’t matter if you do swing trading, day trading, scalping, or binary trading – risk management is critical.

Let’s talk about how to control risk and the importance of a good risk reward ratio.

Most traders stop trading because they make significant losses. If you want to become a successful trader, you need to focus on doing what you can to reduce the size of your losses when they happen.

When trading on a margin account, you can quickly lose all your money if a trade goes against you, and your position size is too big for your account.

Simultaneously, you also need to optimize your trade size to make the biggest possible profit according to your risk preference on each trade.

By knowing how to manage risks, you can play the long game and start making consistent profits.

Why Is Risk Management Important?

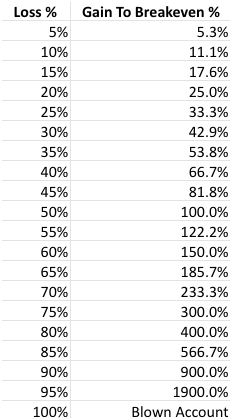

Risk management is important because if you don’t manage your risk, you will most likely lose a significant portion of your trading account. The percentage gain you have to make back to breakeven increases exponentially the more you lose.

5 Risk Management Quotes

“Don’t focus on making money; focus on protecting what you have.” – Paul Tudor Jones

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“When I get hurt in the market, I get the hell out. It doesn’t matter at all where the market is trading. I just get out, because I believe that once you’re hurt in the market, your decisions are going to be far less objective than they are when you’re doing well… If you stick around when the market is severely against you, sooner or later they are going to carry you out.” – Randy McKay

“Frankly, I don’t see markets; I see risks, rewards, and money.”– Larry Hite

“The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.” – Ed Seykota

Risk Management Basics

Anything can happen in the markets.

And anything can affect the price of a coin, token, stock, forex pair, or commodity negatively or positively.

Instead of “going all in” (most often results in blown accounts) as most beginners do, it’s better to manage your risk because if you lose, you will still be able to take the next trade.

“Going all in” is a common mistake, especially amongst beginner traders just starting to trade.

The two most important rules of risk management are:

1. You should never risk more than you can afford to lose.

2. You should always trade with a good Risk Reward Ratio (RRR).

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – George Soros