You will be amazed at how much your trading improves when you start practicing one, two, or all of these trading rules.

Many beginner traders come into trading because of the profitability, forgetting that trading involves high risk. Without proper education, learning, and practicing, they dive in.

To successfully trade the markets, you need to learn and follow successful trading rules and trade tested and proven systems with an edge.

This is how the best traders in the game, traders who have mastered the best trading rules and market timing, make consistent trading profits.

As the saying goes, “to be the best, you have to learn from the best.”

1. Trade A Trading Strategy That Suits You

This one is important. To be a successful trader, you must trade successful trading strategies.

For example – do you:

- Like swing trading – learn and trade a swing trading strategy

- Like fundamentals – research and follow a strategy around fundamentals

- Like trading reversals – learn and trade a tops and bottoms trading strategy

- Like to scalp or trade binary – trade a strategy that works on lower time frames

Taking random trades will not give you an edge in the markets.

So when you follow a strategy, don’t give up if you have a few losses.

Jumping between different strategies is one of the many common mistakes among beginners.

No trading strategy will always work.

The best traders in the world spend time learning a strategy that suits them and building a trading system around it.

They have the discipline and patience to build their confidence and trading account.

“An idiot with a plan can beat a genius without a plan.” – Warren Buffett

2. Analyze Price Charts

One trading rule that most successful traders share is analyzing price charts to find the best entry and exit points.

Even if they analyze fundamentals, they almost always look at price charts for timing trades.

Learning how to read candlestick charts is an essential skill for traders.

You can get started with free charting software to practice and develop your chart reading skills.

Whether you’re a beginner or already have some experience as a trader, start analyzing the longer-term charts, like the weekly and daily charts.

That will help you find the most significant price moves to trade successfully.

“Most of the time trailing stops are more profitable than profit targets. We need the big wins to pay for the losing trades. Trends tend to go farther than anyone anticipates.” – Unknown

3. Take Complete Responsibility

The best traders take complete responsibility for every trade they take and every decision they make.

The best traders in the world never blame someone else or something else for their trading losses or the consequences of their failures.

When something goes wrong, the best traders take responsibility.

Here’s the truth:

You are going to make trading losses and mistakes.

Accept that fact, take responsibility, and learn from your trading losses and mistakes.

4. Learn From Every Trade

I know many traders who can’t figure out why they don’t make the returns they know they can have.

I’ve tried to explain to them that they need to track what they are doing to identify mistakes.

Without a trading journal where you track your trades, it’s hard to remember what made you act in a certain way at the time.

The best traders in the world track their trades. That enables them to learn from every trade and thereby advance their skills as traders.

And when you advance your skills as a trader, you make more money.

Tracking your trading does not have to be complicated.

For example:

Take a screenshot of your chart, use an Excel document or pen and paper to write down the security, date, price, stop price, setup, and thoughts behind the trade.

When you close your position, you write down the date and price if you followed your rules, gain/loss, and thoughts about the trade.

Simple as that!

5. Successful Trading Is Part Of A Balanced Life

Success is so much more than being a profitable trader.

You can’t neglect:

- Health

- Wealth

- Family

- Love

- Lifestyle

- Spirituality

The best traders in the world keep a balance between these.

They understand that focusing on only trading does not equal success.

But maintaining balance is not easy.

There are times when your focus is on other areas, and trading is neglected.

That’s part of your life’s journey.

A happy family, healthy body, and relaxing hobbies will help you and stay emotionally disciplined.

So to become the best trader you can be, make trading part of a balanced life.

“The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading.” – Victor Sperandeo

6. Never Lose Courage

The scarier the trade is to take, the better is most often is.

That is why professional traders have developed courage in themselves and their trading plan.

You need to trade with no fear of trading to become a successful trader.

Always follow your trading plan and rules. No matter what you hear on the news, friends say, etc.

‘”The time to buy when there is blood in the streets.” – Baron Rothschild

7. Don’t Dig Yourself Into A Hole

If I had to pick a number one rule in trading, this is certainly a candidate.

Before you open a trade, always predetermine your max loss for the trade.

If you don’t, you are likely to hold onto losing positions, hoping they will reverse.

Hoping will only result in significant losses over the long run.

For example:

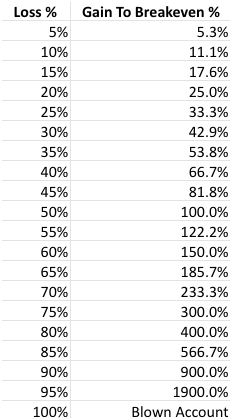

If you have a 50% loss on your account, a 50% gain will not result in you becoming breakeven.

If you have a 50% loss on your account, you need a 100% gain to breakeven.

And it’s not fun if you have to spend days, months, or years digging yourself out of a hole you got yourself into in the early days of trading.

Start slow, observe, and practice on a demo account.

So how do you avoid digging yourself into a hole?

Have a risk management strategy.

“I’m always thinking about losing money as opposed to making money. Don’t focus on making money, focus on protecting what you have” – Paul Tudor Jones

8. If You Think You Are Wrong, Get Out

This rule is, for some reason, easily forgotten or ignored.

You can’t be right with your market timing all the time.

If you are wrong, get out.

Listen to that little voice in your head, telling you that you are wrong. I have heard traders say:

“I know I am wrong” – as they continue to hold on to their position and lose more money.

Most often, they’ve not accepted the fact that losses will happen.

Meanwhile, new setups with high probability occur continuously.

At the sign of being wrong when your trade reach your stop loss level, get out.

Then look to open a new trade in a setup with a higher probability than your losing position.

“The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance.” – Ed Seykota

9. Wait For Your Trade Setup To Play Out

Successful traders never “jump the gun.”

For example:

– Never close profits early (wait for your take profit target).

– Never chase the market (if you missed a setup, wait for the next one).

Traders who “jump the gun” most often lose a lot of money.

Exercise patience when you’re waiting for your trade setups to plays out.

Bear in mind that a successful trader can be compared to a lion, an amazing predator due to its great stalking skills, and a patient one at that, always waiting for the perfect opportunity to go for the kill and what’s more when he goes for it he rarely misses.

“Money is made by sitting, not trading.” – Jesse Livermore

10. Follow A Trading Plan

The best traders in the world never trade on emotions, tips, or whatever catches their attention because they know it doesn’t work in the long run.

The best and most profitable traders have a proven trading plan.

Preparation is an essential aspect of successful trading.

You only want to trade when you get a trade setup that follows your plan.

Just because the market is open does not mean that you should be trading all the time.

Successful traders plan their trades and then trade their plan. So should you.

“The goal of a successful trader is to make the best trades.” – Alexander Elder